Customer Lifetime Value (CLV). An often-overlooked metric that can accurately predict how much your customers are really worth. So how do you calculate it? And how should you use CLV to make decisions?

There are a range of tools and programs out there for calculating CLV that utilise predictive customer modeling to forecast anticipated CLV, you may find that a number of your existing programs already have this capability – e.g. Marsello, Klaviyo, Gorgias. We recommend making use of these tools to really hone in on your customer segments and better target your high-value customers.

However, as a good starting point, we outline below how you can manually calculate your average CLV and use that to make decisions on how much you can spend to acquire new customers. Note that this calculation utilises historical data and provides a general metric rather than one that analyses segments of customers.

You’ll need to track down three key pieces of data within your pre-established timeframe: Average Order Value, Purchase Frequency, and Customer Value.

Average Order Value

Average Order Value represents the average amount of money that a customer spends every time they place an order. To get this number, you’ll need to take your total revenue and divide it by your total number of orders.

If you own a Shopify store, you can find this information by heading to the Reports section of your Admin and taking a look at your Sales by the Month. You’ll just need to divide your Total Sales by your Order Count for the past year. To get a more accurate number, be sure to click Define under Total Sales and uncheck everything except for Subtotal.

Purchase Frequency

Purchase Frequency represents the average amount of orders placed by each customer. Using the same timeframe as your Average Order Value calculations, you need to divide your total number of orders by your total number of unique customers. The result will be your Purchase Frequency. Shopify store owners can also find this data in their Reports under Sales by Customer.

Customer Value

Customer value represents the average monetary value that each customer brings to your business during a timeframe. To calculate your Customer Value, you’ll just need to multiply your Average Order Value by your Purchase Frequency.

Now that you have the Customer Value of your customer base, calculating the CLV is as simple as taking your Customer Value and multiplying it by the average customer lifespan.

Customer Lifespan

Your average customer lifespan is the length of time that your relationship with a customer typically lasts before they become inactive and stop making purchases permanently. The difficulty with e-commerce businesses is identifying when an active customer (someone who makes purchases and will continue to make purchases) becomes an inactive customer (someone who will never make a purchase from your business again).

Instead of attempting to calculate this complex metric, we recommend following the advice of proven e-commerce experts. Shopify and analytics guru Avinash Kaushik has determined 1-3 years to be a reasonable timespan for which customers remain active. For stores that know their customers have a limited attention span, such as niche holiday-specific products like board games, a shorter span like 1 or 2 years may be appropriate.

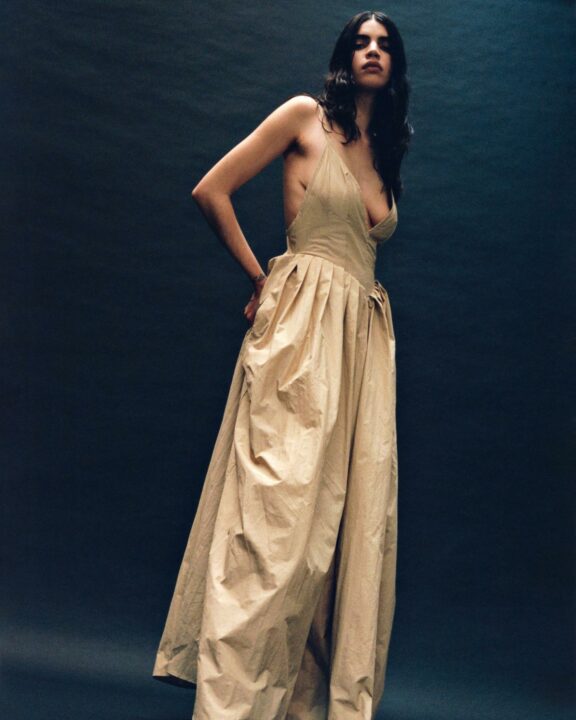

For a clothing brand that continues to produce new collections for years to come, your customers will most likely stay loyal for longer and continue to support the brand for closer to 3 years.

How do you use CLV?

The core benefit of knowing your CLV is that you can then work out how much you can spend to acquire new customers. Typically speaking, we recommend you should be aiming to ensure a customer spends four times as much in their lifespan as it costs to get acquire them. E.g. if it costs you $100 to acquire a new customer, you need them to spend at least $400 over their lifetime with you.

To work out how much you’re spending to acquire new customers, simply divide your total marketing budget by the number of new customers who acquired during this timeframe. The difference between your CLV and your cost per acquisition is your Return on Investment. This is the amount of revenue that customer brings you after you’ve deducted what it cost you to acquire them in the first place.

In doing this calculation, we recommend you take account of what your marketing spend is being used for and whether that is related to acquiring new customers. For example, inviting your existing customers to a new store opening or generating engagement within your existing customer base may not be included in the ‘new customer’ marketing budget.

You can also work out how much you should spend on your paid advertising campaigns. To do this, you need to know your conversion rate. For instance, if your Customer Lifetime Value is $100 and the conversion rate for one of your marketing campaigns is 10%, then your maximum bid for that campaign should be 10% of $100. So, in this scenario, you’d be able to bid a maximum of $10 per click without blowing your budget.

You don’t need to make crazy calculations, you just need to be aware of the value that a customer provides over the course of their life. Being aware of your Customer Lifetime Value gives you greater visibility of your customers and allows you to make smart marketing decisions that generate long-term growth.